Fintech Zoom GME Stock Prediction

The stock market’s dynamic nature means investors are constantly on the lookout for the latest insights and predictions. One stock that has remained a focal point of attention is GameStop Corporation (GME). The dramatic rise of GME in early 2021, driven by retail investor enthusiasm and a short squeeze, highlighted the power of social media in influencing stock prices. As we progress through 2024, understanding the Fintech Zoom GME stock prediction can provide valuable insights for investors.

1. The GameStop Phenomenon: A Brief Recap

In early 2021, GameStop’s stock price experienced a meteoric rise, primarily due to a short squeeze initiated by retail investors on platforms like Reddit’s WallStreetBets. This surge was a result of investors betting against GME stock being forced to buy shares at higher prices to cover their positions. This event showcased the influence of collective trading and the volatility that can arise from social media-driven movements.

2. Fintech Zoom: A Tool for Stock Prediction

Fintech Zoom has emerged as a crucial platform for analyzing and predicting stock movements, including the GME stock prediction. By leveraging advanced algorithms and up-to-date data, Fintech Zoom provides investors with valuable insights into stock performance. For those tracking GameStop, Fintech Zoom GME stock prediction tools offer critical information about potential future movements and trends.

3. Analyzing GME Stock with Fintech Zoom

3.1. Business Model Shifts

GameStop has been undergoing significant changes to adapt to the digital era. The company has moved from a traditional retail model to focus more on e-commerce and digital sales. These shifts are aimed at revitalizing GameStop’s business model and improving its market position. For a comprehensive view of these changes, the Fintech Zoom GME stock prediction can shed light on how these business transformations may impact future stock performance.

3.2. Financial Health Metrics

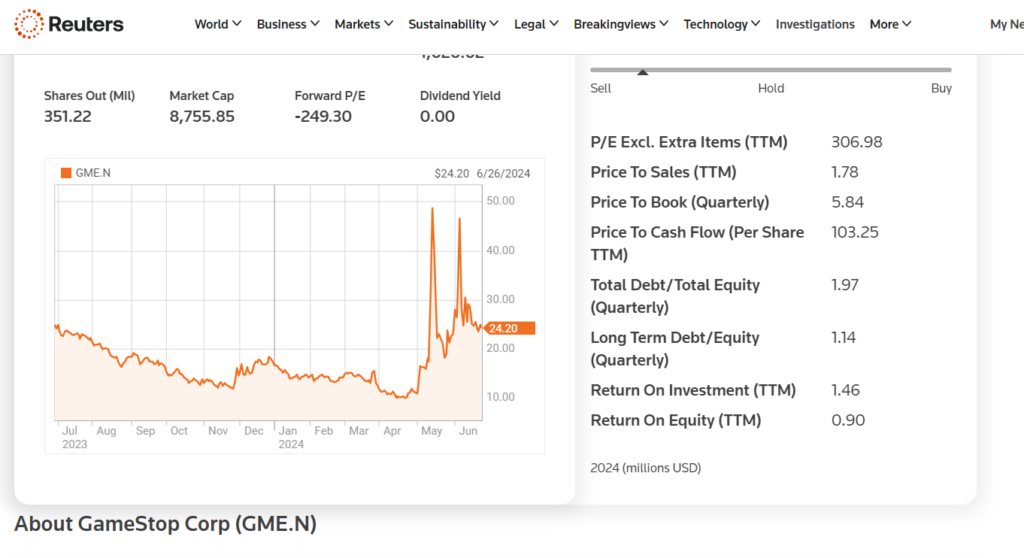

Understanding GameStop’s financial health is essential for evaluating its stock prospects. Key metrics such as revenue growth, profitability, and cash flow are crucial. The Fintech Zoom GME stock prediction incorporates these financial indicators to offer a clearer picture of GameStop’s financial stability and its potential impact on stock price.

3.3. Market Sentiment Insights

Market sentiment significantly affects stock prices, and GME is no exception. The stock’s history of volatility means that investor sentiment can heavily influence its performance. Fintech Zoom provides sentiment analysis tools that monitor social media and news sources, contributing to a comprehensive Fintech Zoom GME stock prediction.

4. Future Outlook: Fintech Zoom GME Stock Prediction Factors

4.1. Technological Innovations

The gaming industry is rapidly evolving with technological advancements such as VR and AR. GameStop’s ability to adapt to these innovations may affect its future stock performance. The Fintech Zoom GME stock prediction can help investors understand how these technological trends might influence GameStop’s stock value.

4.2. Competitive Pressures

GameStop operates in a highly competitive environment with major players like Sony and Microsoft. The competitive landscape impacts GameStop’s market share and profitability. Utilizing the Fintech Zoom GME stock prediction can provide insights into how GameStop is positioning itself against competitors and what this means for its stock.

4.3. Regulatory Changes

Regulatory developments can affect stock trading and performance. Changes in regulations related to short selling and market manipulation could impact GME’s stock. Fintech Zoom offers updated predictions that consider these regulatory factors, helping investors understand their potential impact on GameStop’s stock.

4.4. Economic Indicators

Broader economic conditions, such as inflation and interest rates, also influence stock prices. The Fintech Zoom GME stock prediction takes into account these economic factors to offer a more nuanced outlook on GameStop’s future stock performance.

5. Leveraging Fintech Zoom for GME Stock Predictions

5.1. Technical Analysis Tools

Fintech Zoom provides advanced technical analysis tools that are essential for predicting stock movements. For GME, these tools analyze historical price data, chart patterns, and technical indicators, contributing to a detailed Fintech Zoom GME stock prediction.

5.2. Sentiment Analysis Capabilities

The sentiment analysis tools available on Fintech Zoom help gauge investor mood and market perception. By evaluating social media trends and news sentiment, Fintech Zoom enhances its GME stock prediction with a comprehensive view of market sentiment.

5.3. Financial Forecasts

Fintech Zoom offers financial forecasts that include revenue projections and profit estimates. These forecasts are crucial for understanding the potential trajectory of GME’s stock price. The Fintech Zoom GME stock prediction provides a forward-looking perspective based on current financial data and market conditions.

6. Conclusion

As GameStop continues to navigate its evolving business landscape, the Fintech Zoom GME stock prediction remains a valuable tool for investors. Understanding the factors influencing GME’s stock—such as business model changes, financial health, market sentiment, and broader economic conditions—can help investors make informed decisions. By leveraging Fintech Zoom’s analytical tools and insights, investors can gain a clearer picture of GameStop’s future prospects and make strategic investment choices.

In summary, staying updated with the Fintech Zoom GME stock prediction offers a comprehensive view of potential stock movements and trends, crucial for making well-informed investment decisions.